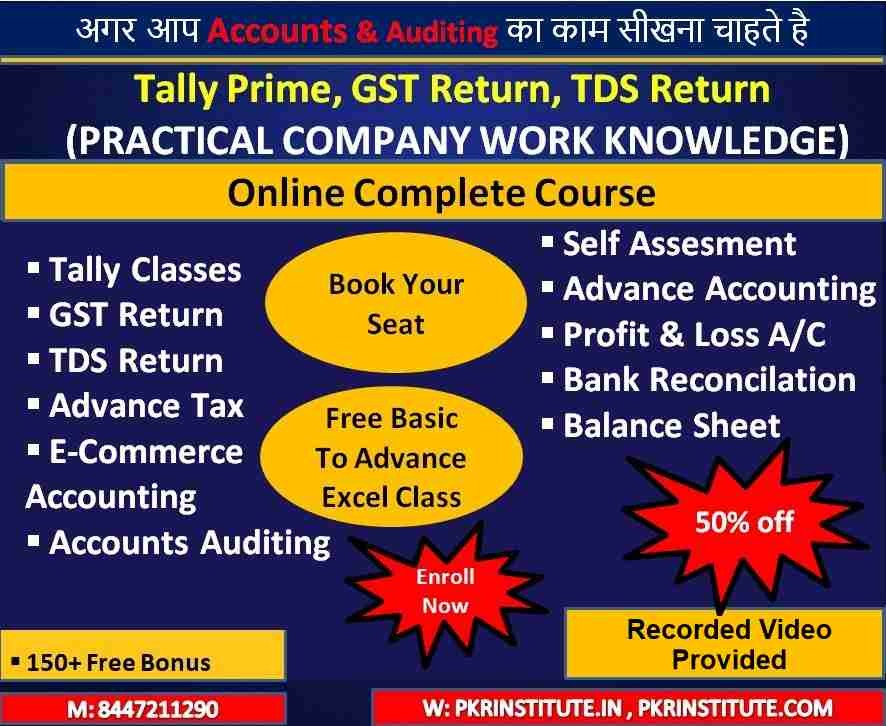

Tally Prime is an all-in-one business management solution designed specifically for use by small and medium-sized companies. Tally Prime assists you in managing accounting, inventory, banking, taxation, payroll, and a great deal more so that you can eliminate difficulties and, as a result, concentrate on expanding your firm. PKR Institute Courses provides this training by highly qualified trainers.

Want to learn the essentials of this program quickly? Enroll in our online Tally classes and get started today. We offer training for novices and students with more advanced knowledge, so feel free to sign up for whichever course you feel will be most helpful.

This course will help you understand the program well so you can work through it independently. As a result, you will be able to gain tools and skills that will help you keep track of your books, plan future tax burdens and complete your annual returns.

Practical in Govt. Portal

Learners interested in the Accounting, Finance, MIS, Data Analysis, Tax, and Business Management Sectors should consider enrolling in the GST course. Keeping up with the requirements of the GST has become much easier thanks to software, and this improvement is also covered in training.

The course is divided into various modules that go over the requirements of the GST, how to apply for a registration number, and how to complete various forms. The most important module is the third, which explains how to complete the different applications and documents needed to file for GST.

- Introduction of GST

In this module, you will learn about the Goods and Services Tax. You will learn about its importance, implementation, and the factors determining GST rates.

- Definitions

This module will teach you the Goods and Services Tax definitions. You will learn what they are, how they work, and their differences.

- Rates

This module will teach you the GST rates. You will learn the new rates that have been implemented, as well as the old ones.

- GST Registration

This module will teach you how to apply for GST registration and the important documents you need to apply for this registration.

- Block credit

An essential provision for every regular taxpayer subject to GST is in Section 17(5) of the CGST Act. This provision is also known as blocked credits.

It establishes a list of acquisitions on which GST is charged, but the Input Tax Credit cannot be claimed for certain acquisitions by enterprises (ITC) under the GST regime. PKR Institute Courses will help you to understand and remember the important factors that should be considered while calculating ITC.

- How to Input Claim

This module will teach you the process for calculating ITC. It will give you explanations about Input Tax Credit, input tax credit amount, input tax credit limit, Input Tax Credit claim form, and other forms that a registered taxpayer has to file to claim the ITC.

- GST Returns

This module will teach you the process for filing GST returns. It will explain GST returns, forms, and other forms that a registered taxpayer must file to claim the ITC.

- GST Due Dates

Talking about the due dates of GST, let’s first understand the various kinds of due dates that can be applied to a GST return in this module.

- Reverse Charge Mechanism

The term “reverse charge” refers to a situation in which the recipient of a supply of goods or services rather than the provider of such goods or services is responsible for making tax payments about recognized categories of supply.

This module will give you a basic understanding and how to decide whether you should use the reverse charge mechanism or not.

- GST Reconciliation

Reconciling the Goods and Services Tax (GST) requires matching the data on sales and purchases from each of the various returns and the sales and purchase registers.

The task of GST reconciliation is made easier in the absence of the input tax credit, for it is not involved in the process. This module will familiarize you with the importance of the GST reconciliation process.

- GST Entries

This module will teach you how to make GST entries. It will explain different aspects of GST, like – GST rate and credit, how an entry is made, how a rebate is claimed, and more.

Basic Concept of TDS

TDS, or Tax Deducted at Source, is a mechanism introduced by the income tax authorities to collect tax at the source of income generation. It requires the payer of certain types of income to deduct tax at a specified percentage before making a payment to the payee. The deducted tax amount is then remitted to the government on behalf of the recipient.

Here’s a breakdown of the TDS process:

- Applicability: TDS is applicable to various types of income, including salaries, interest, rent, professional fees, commission, royalties, and dividends, among others. The Income Tax Act, 1961, specifies the types of payments subject to TDS and the rates at which TDS should be deducted.

- Deduction: The person making the payment, known as the deductor or payer, is responsible for deducting TDS at the time of making the payment or crediting the payee’s account, whichever is earlier. The deductor then issues a TDS certificate to the payee, indicating the amount of tax deducted.

- Rates: TDS rates vary depending on the nature of the payment, the status of the payee (individual, HUF, company, etc.), and other relevant factors. The Income Tax Act and related rules prescribe the rates for TDS deduction.

- Depositing TDS: The deductor is required to deposit the TDS amount deducted to the government within the specified due dates. This amount is deposited using Challan ITNS 281 through authorized banks. The TDS amount is credited to the payee’s PAN (Permanent Account Number) and can be verified through Form 26AS, which is the Annual Tax Statement.

- Filing TDS Returns: The deductor is also required to file TDS returns periodically, providing details of TDS deductions made during the relevant period. These returns are filed online through the TRACES portal (TDS Reconciliation Analysis and Correction Enabling System).

- TDS Certificate: The deductor issues a TDS certificate to the payee, providing details of the TDS deductions made. The payee can use this certificate to claim credit for the TDS amount deducted while filing their income tax return.

Note:-

Course Content – Recorded Classes

- Tally Prime

- Bank Reconciliation

- Profit & loss A/c

- Balance Sheet

- Voucher Entries

- Transport Entries

- All Other Voucher and Technical

- Basic Concept of GST

- Documents Required for GST Registration

- GST Returns

- TDS Returns

- Advance Excel with Chat GPT

Course Features

- Lectures 62

- Quiz 0

- Duration 52 weeks

- Skill level All levels

- Language English

- Students 73

- Certificate No

- Assessments Yes

Curriculum

- 2 Sections

- 62 Lessons

- 52 Weeks

- Tally GST TDS Course 21/08/202462

- 1.1Tally Classes 01st day on Dt. 21/08/2024

- 1.2Tally Classes 02nd day on Dt. 22/08/2024

- 1.3Tally Classes 3rd day on Dt. 23/08/2024

- 1.4Tally Classes 4th day on Dt. 24/08/2024

- 1.5Tally Classes 5th day on Dt. 25/08/2024

- 1.6Tally Classes 6th day on Dt. 27/08/2024

- 1.7Tally Classes 7th day on Dt. 28/08/2024

- 1.8Tally Classes 8th day on Dt. 29/08/2024

- 1.9Tally Classes 9th day on Dt. 30/08/2024

- 1.10Tally Classes 10th day on Dt. 31/08/2024

- 1.11Tally Classes 11th day on Dt. 01/09/2024

- 1.12Tally Classes 12th day on Dt. 03/09/2024

- 1.13Tally Classes 13th day on Dt. 04/09/2024

- 1.14Tally Classes 14th day on Dt. 05/09/2024

- 1.15Tally Classes 15th day on Dt. 06/09/2024

- 1.16Tally Classes 16th day on Dt. 07/09/2024

- 1.17Tally Classes 17th day on Dt. 08/09/2024

- 1.18Tally Classes 18th day on Dt. 10/09/2024

- 1.19Tally Classes 19th day on Dt. 11/09/2024

- 1.20GST Classes 1st Day 17/09/2024

- 1.21GST Classes 2nd Day 18/09/2024

- 1.22GST Classes 3rd Day 19/09/2024

- 1.23GST Classes 4th Day 20/09/2024

- 1.24GST Classes 5th Day 21/09/2024

- 1.25GST Classes 6th Day 22/09/2024

- 1.26GST Classes 7th Day 25/09/2024

- 1.27GST Classes 8th Day 26/09/2024

- 1.28GST Classes 9th Day 27/09/2024

- 1.29GST Classes 10th Day 28/09/2024

- 1.30GST Classes 11th Day 29/09/2024

- 1.31GST Classes 12th Day 01/10/2024

- 1.32GST Classes 13th Day 02/10/2024

- 1.33GST Classes 14th Day 03/10/2024

- 1.34TDS Classes 01st Day 07/10/2024

- 1.35TDS Classes 2nd Day 08/10/2024

- 1.36TDS Classes 3rd Day 09/10/2024

- 1.37TDS Classes 4th Day 10/10/2024

- 1.38TDS Classes 5th Day 12/10/2024

- 1.39TDS Classes 6th Day 13/10/2024

- 1.40GST Classes 15th Day 15/10/2024

- 1.41GST Classes 16th Day 16/10/2024

- 1.42TDS Classes 7th Day 17/10/2024

- 1.43TDS Classes 8th Day 19/10/2024

- 1.44TDS Classes 9th Day 20/10/2024

- 1.45TDS Classes 10th Day 22/10/2024

- 1.46TDS Classes 11th Day 23/10/2024

- 1.47TDS Classes 12th Day 24/10/2024

- 1.48TDS Classes 13th Day 25/10/2024

- 1.49Balance Sheet 01st Day 26/10/2024

- 1.50Balance Sheet 2nd Day 27/10/2024

- 1.51Balance Sheet 3nd Day 29/10/2024

- 1.52Advance Excel 01st day 05/11/2024

- 1.53Advance Excel 02nd day 06/11/2024

- 1.54Advance Excel 03rd day 07/11/2024

- 1.55Advance Excel 04th day 08/11/2024

- 1.56Advance Excel 05th day 09/11/2024

- 1.57Advance Excel 06th day 10/11/2024

- 1.58Advance Excel 07th day 12/11/2024

- 1.59Advance Excel 08th day 13/11/2024

- 1.60Advance Excel 09th day 15/11/2024

- 1.61Advance Excel 10th day 16/11/2024

- 1.62GSTR 2B and 3B Updated Class 17/11/2024

- Quiz0

4 Comments

Good claas

Very nice class and growth in job after this class.

All classes practical based as per company work and thanks to Pankaj sir

Practical based class.

Accounting

GST Returns

TDS Returns

Advance excel

Advance tax

Self Assessment