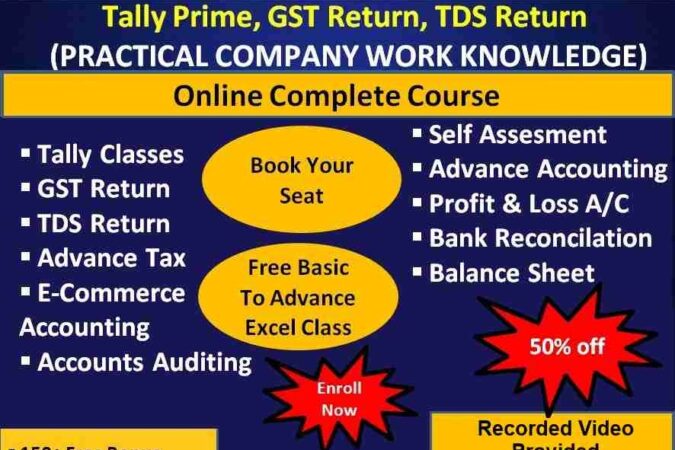

(A) ITR-1, also known as Sahaj, is the Income Tax Return form used by individual taxpayers in India. If you’re looking for class or training-related topics on ITR-1, here’s a well-organized list of subjects you can cover. These are useful for teaching or learning about filing ITR-1:

📘 Basics of ITR-1

-

What is ITR-1 (Sahaj)?

-

Who can file ITR-1?

-

Who cannot file ITR-1?

-

Difference between ITR-1 and other ITR forms

-

Eligibility Criteria for ITR-1

📄 Structure of ITR-1 Form

-

Part A: General Information

-

Part B: Gross Total Income

-

Part C: Deductions and Taxable Total Income

-

Part D: Tax Computation and Tax Status

-

Verification Section

-

Schedule DI – Details of Investments

-

Schedule 80D (Health Insurance Deductions)

💰 Sources of Income Covered Under ITR-1

-

Income from Salary / Pension

-

Income from One House Property

-

Income from Other Sources (e.g., interest)

-

Exempt Income (e.g., PPF interest, tax-free bonds)

🧾 Deductions and Exemptions

-

Section 80C (LIC, PF, ELSS, etc.)

-

Section 80D (Health Insurance)

-

Section 80TTA / 80TTB (Interest from Savings A/C)

-

Section 80G (Donations)

-

Other deductions (80CCD, 80E, etc.)

🖥️ How to File ITR-1

-

Filing ITR-1 Online (via e-Filing portal)

-

Pre-filled ITR Forms – Benefits and Verification

-

Using Aadhaar OTP / EVC / DSC for Verification

-

Steps to file through Income Tax Website

📅 Important Dates and Deadlines

-

ITR Filing Due Dates

-

Revised Return

-

Belated Return

-

Late Fees under Section 234F

⚠️ Common Mistakes to Avoid

-

Mismatch in Form 16 and Form 26AS

-

Incorrect Bank Details

-

Not declaring exempt income

-

Failing to verify return

📑 Documents Required

-

Form 16 / Salary Slip

-

Form 26AS & AIS

-

Bank Interest Certificates

-

Investment Proofs for Deductions

-

Aadhaar and PAN

🧮 Tax Calculation in ITR-1

-

Old vs New Tax Regime (from AY 2021-22)

-

Rebate under Section 87A

-

TDS and Advance Tax

🔁 After Filing ITR

-

E-verification Methods

-

Checking ITR Status

-

Refund Status and Processing

-

Rectification / Revised Return

(B) Here’s a structured list of ITR-4 (Sugam) class-related topics for training, workshops, or self-study. ITR-4 is used by individuals, HUFs, and firms (other than LLPs) who have presumptive income from business or profession.

🧾 ITR-4 (Sugam) Class Topics

📘 1. Introduction to ITR-4

-

What is ITR-4 (Sugam)?

-

Applicability: Who can file ITR-4?

-

Inapplicability: Who cannot file ITR-4?

-

Difference between ITR-1 and ITR-4

-

Meaning of Presumptive Income

🧑💼 2. Eligibility Criteria for ITR-4

-

Individuals, HUFs, and Firms (except LLPs)

-

Income under Sections 44AD, 44ADA, and 44AE

-

Total income up to ₹50 lakhs

-

Income from one house property, salary/pension, other sources

📊 3. Presumptive Taxation Schemes

-

Section 44AD: Business income (8%/6%)

-

Section 44ADA: Professionals (50% of gross receipts)

-

Section 44AE: Income from goods carriages

-

Benefits and limitations of presumptive taxation

📄 4. Structure of ITR-4 Form

-

Part A: General Information

-

Part B: Gross Total Income

-

Part C: Deductions and Taxable Income

-

Part D: Tax Computation and Status

-

Schedule BP: Business/Profession Details

-

Schedule 80G, 80D, 80GGA etc.

-

Schedule AL (Assets & Liabilities) — if applicable

-

Schedule IT, TCS, TDS1, TDS2

🧮 5. Income Sources Covered

-

Income from Business (Presumptive)

-

Income from Profession (Presumptive)

-

Salary or Pension

-

Income from One House Property

-

Income from Other Sources (e.g., bank interest)

📉 6. Deductions under Chapter VI-A

-

Section 80C to 80U (LIC, PPF, 80D, 80G, etc.)

-

Section 80JJAA (for new employment – business case)

-

Rebate under Section 87A

-

Tax regime selection: Old vs New (Section 115BAC)

🧾 7. Documents Required for Filing

-

PAN, Aadhaar, Bank Details

-

Business turnover/receipts summary

-

Professional receipts (if 44ADA)

-

Details of assets (if applicable)

-

TDS Certificates, Form 26AS, AIS/TIS

🧠 8. Important Concepts to Teach

-

Gross Receipts vs Turnover

-

Calculation of Presumptive Income

-

Books of Accounts: When not required

-

Audit requirement when not opting for presumptive scheme

-

Advance Tax in presumptive taxation

💻 9. Filing Process of ITR-4

-

How to file on the Income Tax Portal

-

Pre-filled data and manual input

-

Using Aadhaar OTP, EVC, or DSC for verification

-

Downloading ITR-V and e-verification

🧯 10. Common Mistakes and Errors

-

Wrong Section selection (44AD vs 44ADA)

-

Mismatch in turnover and bank entries

-

Not opting in/out properly for presumptive income

-

Missing Schedule AL for higher income

-

Not verifying ITR

🗓️ 11. Key Due Dates and Penalties

-

Filing due dates for individuals and firms

-

Late filing fee under Section 234F

-

Interest under Section 234A/B/C

-

Revised Return and Belated Return

🏁 12. Post Filing Activities

-

E-verification methods

-

Refund tracking

-

Rectification of errors

-

Compliance notices and responses

Course Features

- Lectures 3

- Quiz 0

- Duration 30 days

- Skill level All levels

- Language English

- Students 13

- Certificate No

- Assessments Yes

Curriculum

- 1 Section

- 3 Lessons

- 30 Days

- Income Tax Returns 22/07/20253