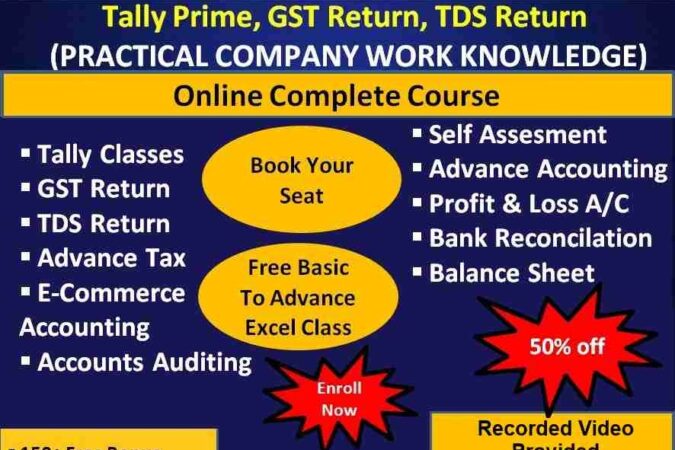

Tally GST TDS & ITR Professional Certification Course Online/ F2F

!! Practical Company Work Knowledge!!

!! Certification Course!!

- Tally Prime Course

A. Before Tally Do You Know ?

➢ Voucher Creation

➢ Making Journal Entries

➢ Ledger Creation

➢ Cash Book

➢ Bank Reconciliation Statement

➢ Trail Balance

➢ Trading and Profit & Loss Account

➢ Balance Sheet

➢ Adjustment

B. Why Tally?

➢ Easy Maintenance

➢ Complete Answer

➢ Most Popular Accounting Software

➢ Internet Support

➢ Reliable, Quick And User Friendly

➢ Various Language Supports

➢ Object Oriented Database

➢ Unique Features

➢ Safety Choices

➢ Visual Analysis and LAN set-up

➢ It’s affordable

➢ All Taxations (Direct and Indirect)

➢ Salary Management

C. Tally Features

❖ It is a leading Accounting Software. Since its inception Tally Accounting Package is being development and will be development on continues basic as per

the industry requirements.

❖ It is user friendly computerized Accounting Software. We can create our own names for our Accounting Data in our own language support various other

languages apart English.

❖ This software provide the complete business solutions. We can manage our accounts either with Inventory or without Inventory. It is suitable from a small

scale firm as well as MNCs.

❖ It enable to work with multiple company simultaneously. It will Update the information in real time as soon as we pass the voucher entries.

❖ We can get support about the software using either Online or Offline help facility. It is window platform independent.

❖ Tally allow us access our accounts remotely using the Tally-NET facility.

D. Unit-1

Introduction of Tally

▪Tally version

▪Creation of a company

▪Base Currency Information

Accounts Information

▪Accounts info

▪Ledger Creation

Voucher Entries

▪Voucher

▪Contra Voucher

▪Payment Voucher

▪Receipt Voucher

▪Journal

Purchase & Sales Entries

▪Purchase Mode

▪Sale Entry Mode

▪Debit Note Mode

▪Credit Note Mode

E. Unit-2

Compound Journal Entries

▪Compound Journal Entries

▪Report Analysis

▪Balance Sheet

▪P &L Accounts

▪Ratio Analysis

Additional Accounting Features

▪Cost Centre and Category

▪Cost Categories

▪Budget

▪Bank Reconciliation

▪Set Credit Limit

Inventory Information

▪Inventory Information

▪Inventory Configuration & Features

▪Creating Location

▪Stock Items

Purchase Process with Inventory Mode

▪Purchase order process

▪To create a Purchase Order

▪Receipt Note Voucher

▪Rejection out Vouchers

▪Purchase invoice

▪Debit Note

F. Unit-3

Sale Process with Inventory Mode

▪Sales order Processing

▪Delivery Note Voucher

▪Rejections in Voucher

▪Sale Invoice

▪Credit Note

Additional Inventory features

▪Using different Actual and Billed Quantities

▪Use additional cost for purchase

▪Use multiple price level

▪Separate discount Column

Job Casting

▪Creating Cost Centre for Job Costing

▪Materials Consumption summary Report

▪Enabling job Casting

▪Job Casting

▪Job Work Analysis Report

Advance Features for Inventory Management

▪Manufacturing Company’s Accounting

▪Bill of Materials

▪Creating Bill of Material for a stock items

G. Unit-4

Additional Features For Accounting-1

▪ Interest Calculation

▪ Interest Calculation on outstanding balance

▪ Interest Calculation transaction by transaction

▪ Interest Calculation in Advance Mode

▪ Report on Interest Calculated on Outstanding transactions/Bills

▪ Memorandum Vouchers

▪ Scenario Creation for non accounting voucher

Additional Accounting Features

▪Post Dated Vouchers

▪Optional Vouchers

Work Contract

▪Job work in order Process

▪Job work out order Process

▪Material in

▪Material out

Export and Import of Data

▪Export Data

▪Import Data

▪Excel Format

▪XML format

▪HTML Format

▪PDF Format

H. Unit -5

Payroll

▪Introduction

▪Payroll Info

▪Creating Employee Groups

▪Creating Payroll Unit

Payment of Salary

▪Voucher Type

▪Attendance

▪Payroll

Creating Attendance Production Types

▪Creating Attendance Type

▪Creating Pay Heads

▪Creating Earnings Pay Head

Various Pay Heads

▪Creating Production Boards

▪Earning Pay Heads

▪Creating Employees Deductions Pay Heads

▪Creating Employees Statutory Deduction of Pay Heads

Contribution of Employer

✓Creating Bonus Pay Head

✓Creating Employee’s NPS Deduction Pay head

✓Creating Employer’s EPS Contribution Pay Head

✓Creating Employer’s EPF Contribution Pay Head

✓Creating Employer’s ESI Contribution Pay Head

✓Creating Employer’s NPS Contribution Pay Head

Employer’s Other Charges

▪Creating Salary Advance Deduction Pay Head

▪Creating Gratuity Pay Head

▪Creating Employer’s other Charges Pay Head

Payroll Reports

▪To view Payroll Reports

▪Single Pay Slip

▪Payroll Statement Creating Employee Group

▪Payroll Register

▪Attendance Reports

Payroll Statutory Reports

▪To view Payroll Statutory Reports

▪Payroll Statutory Pay Head Details

▪Provident Fund Reports

▪Gratuity Reports

2. GST Returns Courses

Practical in Govt. Portal

Learners interested in the Accounting, Finance, MIS, Data Analysis, Tax, and Business Management Sectors should consider enrolling in the GST course. Keeping up with the requirements of the GST has become much easier thanks to software, and this improvement is also covered in training.

The course is divided into various modules that go over the requirements of the GST, how to apply for a registration number, and how to complete various forms. The most important module is the third, which explains how to complete the different applications and documents needed to file for GST.

- Introduction of GST

In this module, you will learn about the Goods and Services Tax. You will learn about its importance, implementation, and the factors determining GST rates.

- Definitions

This module will teach you the Goods and Services Tax definitions. You will learn what they are, how they work, and their differences.

- Rates

This module will teach you the GST rates. You will learn the new rates that have been implemented, as well as the old ones.

- GST Registration

This module will teach you how to apply for GST registration and the important documents you need to apply for this registration.

- Block credit

An essential provision for every regular taxpayer subject to GST is in Section 17(5) of the CGST Act. This provision is also known as blocked credits.

It establishes a list of acquisitions on which GST is charged, but the Input Tax Credit cannot be claimed for certain acquisitions by enterprises (ITC) under the GST regime. PKR Institute Courses will help you to understand and remember the important factors that should be considered while calculating ITC.

- How to Input Claim

This module will teach you the process for calculating ITC. It will give you explanations about Input Tax Credit, input tax credit amount, input tax credit limit, Input Tax Credit claim form, and other forms that a registered taxpayer has to file to claim the ITC.

- GST Returns

This module will teach you the process for filing GST returns. It will explain GST returns, forms, and other forms that a registered taxpayer must file to claim the ITC.

- GST Due Dates

Talking about the due dates of GST, let’s first understand the various kinds of due dates that can be applied to a GST return in this module.

- Reverse Charge Mechanism

The term “reverse charge” refers to a situation in which the recipient of a supply of goods or services rather than the provider of such goods or services is responsible for making tax payments about recognized categories of supply.

This module will give you a basic understanding and how to decide whether you should use the reverse charge mechanism or not.

- GST Reconciliation

Reconciling the Goods and Services Tax (GST) requires matching the data on sales and purchases from each of the various returns and the sales and purchase registers.

The task of GST reconciliation is made easier in the absence of the input tax credit, for it is not involved in the process. This module will familiarize you with the importance of the GST reconciliation process. - GST Entries

This module will teach you how to make GST entries. It will explain different aspects of GST, like – GST rate and credit, how an entry is made, how a rebate is claimed, and more. - IMS DashboardTopics Covered1. Basic Concept of GST

2.Explain GST Number

3.Explain Invoice No.

4.Explain Type of GST

5.Explain GST Registration Limit.

6.Documents Required for GST Registration with Practical in GST Portal.

7.Explain GST Returns – 1,2,3 Technical and Practical and also Explain GSTR 4-10 Technical.

8.GSTR 2A & 2B Reconciliation

9.Explain IMS Dashboard

10.Explain ITC Chart

11.Explain Input Not Claim

12.Explain Reverse Charge mechanism (RCM)

13.GST Payments

14.Ecommerce Accounting with TDS and TCS Credit Received Returns

15.Tax Invoices – Debit Notes/Credit Notes

16.Tax Deduction at source and Tax Collection of tax at sources

17.Explain – B2B, B2C (Large and Other) , Export/Imports , Zero Rated, Exempted Etc.

18.Knowledge of E- Invoicing and E – way Bill

3. TDS Returns Classes

➢Basic Concept of TDS

➢Sections:- 192, 194A, 194B, 194C, 194G, 194H, 194I,194J, 194IA, 194IB, 195, 194Q, 194R

➢DTAA and TRC

➢TDS Payment – Due Dates

➢TDS Return(24Q , 26Q , 27Q, 27EQ)

➢Calculation of Interest on TDS

➢TDS Certificates

➢TDS Returns – Due Dates

➢Advance Tax

➢Self-Assessment

4. Basic to Advance Excel with Chat GPT

➢Basic Excel

➢Home Tab

➢Insert Tab

➢Page layout Tab

➢Formula

➢Review

➢View

➢VLOOKUP

➢HLOOKUP

➢Pivot Table

➢Lookup

➢Match

➢Index

➢MIS Reports

➢Data Analyst

➢Advance Keys

➢Chat GPT

5. Income Tax Return

➢ ITR – 1

➢ITR -4

➢Computation

➢Income Tax return filling for Salary Class

➢Income Tax return filling for business class for Non – Books of Accounts.

Contact Number – 8447211290 / 8930084472

E – pkrinstitute@gmail.com / info@pkrinstitute.com

W – pkrinstitute.in / pkrinstitute.com

Course Features

- Lectures 5

- Quiz 0

- Duration 52 weeks

- Skill level All levels

- Language English

- Students 53

- Certificate No

- Assessments Yes

Curriculum

- 1 Section

- 5 Lessons

- 52 Weeks