HomeAll Courses

Courses

Filter

Showing 1-12 of 18 results

Learn GST practically from scratch and become job-ready GST Practical Course (Online) GST Registration & Returns ITC, RCM, Block Credit HSN / SAC Codes GST Invoices Live Training on GST...

-

11 Lessons

₹4,999.00Free

(A) ITR-1, also known as Sahaj, is the Income Tax Return form used by individual taxpayers in India. If you’re looking for class or training-related topics on ITR-1, here’s a...

-

3 Lessons

₹2,999.00Free

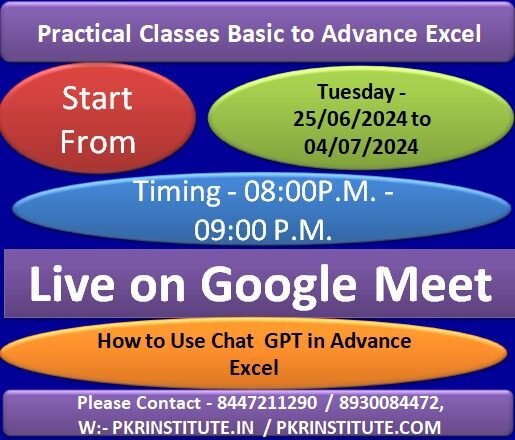

Basic to Advance Excel with Chat GPT ➢Basic Excel ➢Home Tab ➢Insert Tab ➢Page layout Tab ➢Formula ➢Review ➢View ➢VLOOKUP ➢HLOOKUP ➢Pivot Table ➢Lookup ➢Match ➢Index ➢MIS Reports ➢Data Analyst...

-

10 Lessons

₹0.00Free

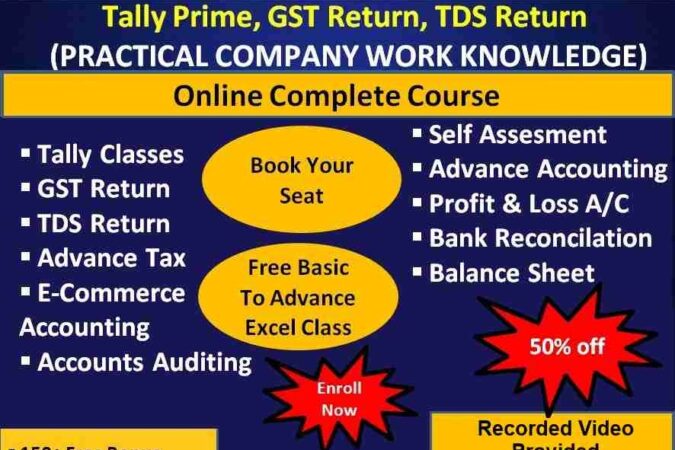

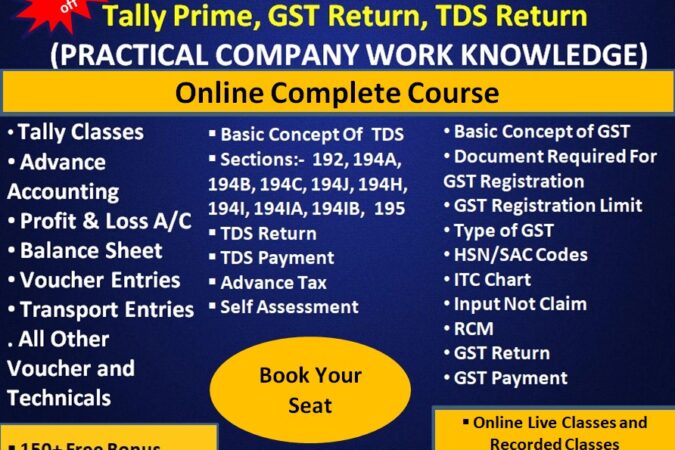

Syllabus Cum Topics Tally GST TDS & ITR Professional Certification Course Online/ F2F !! Practical Company Work Knowledge!! !! Certification Course!! Tally Prime Course A. Before Tally Do You Know...

-

5 Lessons

₹0.00Free

Tally Prime is an all-in-one business management solution designed specifically for use by small and medium-sized companies. Tally Prime assists you in managing accounting, inventory, banking, taxation, payroll, and a...

-

62 Lessons

₹17,000.00Free

Tally Prime is an all-in-one business management solution designed specifically for use by small and medium-sized companies. Tally Prime assists you in managing accounting, inventory, banking, taxation, payroll, and a...

-

56 Lessons

₹16,999.00₹699.00

PKR Institute provide you with a brief outline for a series of Excel tutorials, covering basic to advanced topics. Feel free to adapt the content based on your audience’s needs....

-

1 Lesson

₹999.00₹399.00

Self-assessment is a crucial tool for personal and professional development. It involves critically examining your strengths, weaknesses, skills, and experiences to gain a deeper understanding of yourself and identify areas...

-

0 Lessons

₹1,999.00₹499.00

Course Categories

- Advance Tax (2)

- Balance Sheet and Profit and Loss Account (2)

- Bank Reconciliation (2)

- Computer Course (3)

- GST Returns (2)

- Self Assesement (2)

- Tally Class (2)

- TDS Returns (2)