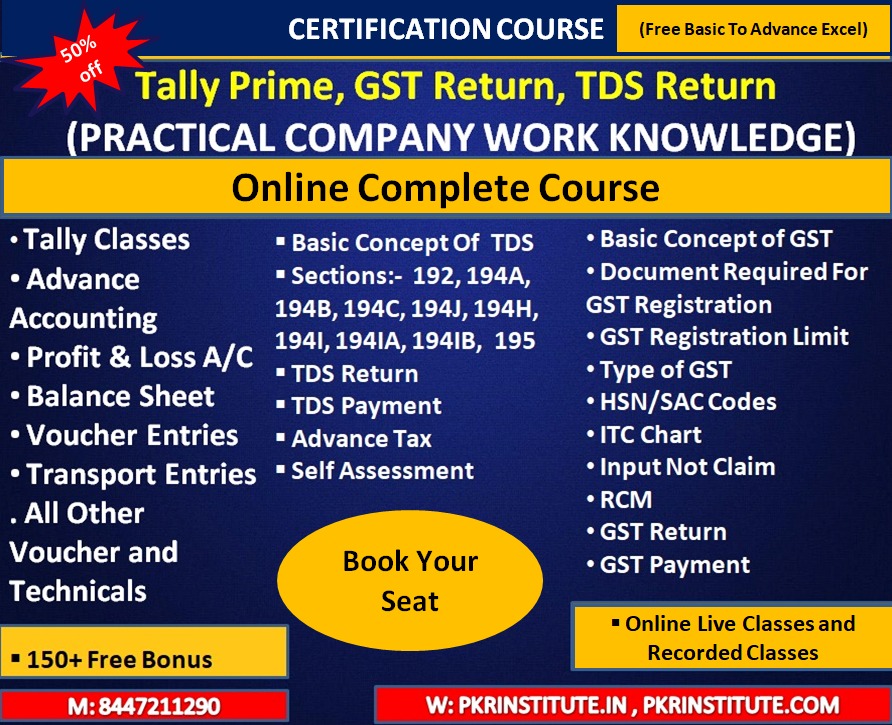

Tally Prime is an all-in-one business management solution designed specifically for use by small and medium-sized companies. Tally Prime assists you in managing accounting, inventory, banking, taxation, payroll, and a great deal more so that you can eliminate difficulties and, as a result, concentrate on expanding your firm. PKR Institute Courses provides this training by highly qualified trainers.

Want to learn the essentials of this program quickly? Enroll in our online Tally classes and get started today. We offer training for novices and students with more advanced knowledge, so feel free to sign up for whichever course you feel will be most helpful.

This course will help you understand the program well so you can work through it independently. As a result, you will be able to gain tools and skills that will help you keep track of your books, plan future tax burdens and complete your annual returns.

Practical in Govt. Portal

Learners interested in the Accounting, Finance, MIS, Data Analysis, Tax, and Business Management Sectors should consider enrolling in the GST course. Keeping up with the requirements of the GST has become much easier thanks to software, and this improvement is also covered in training.

The course is divided into various modules that go over the requirements of the GST, how to apply for a registration number, and how to complete various forms. The most important module is the third, which explains how to complete the different applications and documents needed to file for GST.

- Introduction of GST

In this module, you will learn about the Goods and Services Tax. You will learn about its importance, implementation, and the factors determining GST rates.

- Definitions

This module will teach you the Goods and Services Tax definitions. You will learn what they are, how they work, and their differences.

- Rates

This module will teach you the GST rates. You will learn the new rates that have been implemented, as well as the old ones.

- GST Registration

This module will teach you how to apply for GST registration and the important documents you need to apply for this registration.

- Block credit

An essential provision for every regular taxpayer subject to GST is in Section 17(5) of the CGST Act. This provision is also known as blocked credits.

It establishes a list of acquisitions on which GST is charged, but the Input Tax Credit cannot be claimed for certain acquisitions by enterprises (ITC) under the GST regime. PKR Institute Courses will help you to understand and remember the important factors that should be considered while calculating ITC.

- How to Input Claim

This module will teach you the process for calculating ITC. It will give you explanations about Input Tax Credit, input tax credit amount, input tax credit limit, Input Tax Credit claim form, and other forms that a registered taxpayer has to file to claim the ITC.

- GST Returns

This module will teach you the process for filing GST returns. It will explain GST returns, forms, and other forms that a registered taxpayer must file to claim the ITC.

- GST Due Dates

Talking about the due dates of GST, let’s first understand the various kinds of due dates that can be applied to a GST return in this module.

- Reverse Charge Mechanism

The term “reverse charge” refers to a situation in which the recipient of a supply of goods or services rather than the provider of such goods or services is responsible for making tax payments about recognized categories of supply.

This module will give you a basic understanding and how to decide whether you should use the reverse charge mechanism or not.

- GST Reconciliation

Reconciling the Goods and Services Tax (GST) requires matching the data on sales and purchases from each of the various returns and the sales and purchase registers.

The task of GST reconciliation is made easier in the absence of the input tax credit, for it is not involved in the process. This module will familiarize you with the importance of the GST reconciliation process.

- GST Entries

This module will teach you how to make GST entries. It will explain different aspects of GST, like – GST rate and credit, how an entry is made, how a rebate is claimed, and more.

Basic Concept of TDS

TDS, or Tax Deducted at Source, is a mechanism introduced by the income tax authorities to collect tax at the source of income generation. It requires the payer of certain types of income to deduct tax at a specified percentage before making a payment to the payee. The deducted tax amount is then remitted to the government on behalf of the recipient.

Here’s a breakdown of the TDS process:

- Applicability: TDS is applicable to various types of income, including salaries, interest, rent, professional fees, commission, royalties, and dividends, among others. The Income Tax Act, 1961, specifies the types of payments subject to TDS and the rates at which TDS should be deducted.

- Deduction: The person making the payment, known as the deductor or payer, is responsible for deducting TDS at the time of making the payment or crediting the payee’s account, whichever is earlier. The deductor then issues a TDS certificate to the payee, indicating the amount of tax deducted.

- Rates: TDS rates vary depending on the nature of the payment, the status of the payee (individual, HUF, company, etc.), and other relevant factors. The Income Tax Act and related rules prescribe the rates for TDS deduction.

- Depositing TDS: The deductor is required to deposit the TDS amount deducted to the government within the specified due dates. This amount is deposited using Challan ITNS 281 through authorized banks. The TDS amount is credited to the payee’s PAN (Permanent Account Number) and can be verified through Form 26AS, which is the Annual Tax Statement.

- Filing TDS Returns: The deductor is also required to file TDS returns periodically, providing details of TDS deductions made during the relevant period. These returns are filed online through the TRACES portal (TDS Reconciliation Analysis and Correction Enabling System).

- TDS Certificate: The deductor issues a TDS certificate to the payee, providing details of the TDS deductions made. The payee can use this certificate to claim credit for the TDS amount deducted while filing their income tax return.

Course Features

- Lectures 56

- Quiz 0

- Duration 52 weeks

- Skill level All levels

- Language English

- Students 39

- Certificate No

- Assessments Yes

Curriculum

- 2 Sections

- 56 Lessons

- 52 Weeks

- Tally GST TDS Course56

- 0.0Tally GST TDS Course 1st Day Class 20/04/202455 Minutes

- 0.1Tally GST TDS Course 2nd Day Class 21/04/2024

- 0.2Tally GST TDS Course 3rd Day Class 22/04/2024

- 0.3Tally GST TDS Course 4th Day Class 23/04/2024

- 0.4Tally GST TDS Course 5th Day Class 24/04/2024

- 0.5Tally GST TDS Course 6th Day Class 25/04/2024

- 0.6Tally GST TDS Course 7th Day Class 26/04/2024

- 0.7Tally GST TDS Course 8th Day Class 27/04/2024

- 0.8Tally GST TDS Course 9th Day Class 29/04/2024

- 0.9Tally GST TDS Course 10th Day Class 30/04/2024

- 0.10Tally GST TDS Course 11th Day Class 01/05/2024

- 0.11Tally GST TDS Course 12th Day Class 02/05/2024

- 0.12Tally GST TDS Course 13th Day Class 03/05/2024

- 0.13Tally GST TDS Course 14th Day Revision Class 04/05/2024

- 0.14Tally GST TDS Course 15th Day Class 06/05/2024

- 0.15Tally GST TDS Course 16th Day Class 07/05/2024

- 0.16Tally GST TDS Course 17th Day Class 08/05/2024

- 0.17Tally GST TDS Course 18th Day Class 09/05/2024

- 0.18Tally GST TDS Course 19th Day Class 10/05/2024

- 0.19GST Class 1st Day on 15/05/2024

- 0.20GST Class 2nd Day on 16/05/2024

- 0.21GST Class 3rd Day on 17/05/2024

- 0.22GST Class 4th Day on 18/05/2024

- 0.23GST Class 5th Day on 20/05/2024

- 0.24GST Class 6th Day on 21/05/2024

- 0.25GST Class 7th Day on 22/05/2024

- 0.26GST Class 8th Day on 24/05/2024

- 0.27GST Class 9th Day on 25/05/2024

- 0.28GST Class 10th Day on 27/05/2024

- 0.29GST Class 11th Day on 28/05/2024

- 0.30GST Class 12th Day on 29/05/2024

- 0.31GST Class 13th Day on 30/05/2024

- 0.32GST Class 14th Day on 31/05/2024

- 0.33GST Class 15th Day on 01/06/2024

- 0.34GST Class 16th Day on 03/06/2024

- 0.35TDS Class 1st Day on 04/06/2024

- 0.36TDS Class 2nd Day on 05/06/2024

- 0.37TDS Class 3rd Day on 06/06/2024

- 0.38TDS Class 4th Day on 07/06/2024

- 0.39TDS Class 5th Day on 08/06/2024

- 0.40TDS Class 6th Day on 09/06/2024

- 0.41TDS Class 7th Day on 11/06/2024

- 0.42TDS Class 8th Day on 12/06/2024

- 0.43TDS Class 9th Day on 13/06/2024

- 0.44TDS Advance Tax Self Assessment 26AS AIS Class 10th Day on 14/06/2024

- 0.45TDS Class 11th Day Class 18/06/2024

- 0.46TDS Class 12th Day Class 19/06/2024

- 0.47TDS Class 13th Day Class 20/06/2024

- 0.48Basic to Advance Excel 1st Day on Dt. 25/06/2024

- 0.49Basic to Advance Excel 2nd Day on Dt. 26/06/2024

- 0.50Basic to Advance Excel 3rd Day on Dt. 27/06/2024

- 0.51Basic to Advance Excel 4th Day on Dt. 28/06/2024

- 0.52Basic to Advance Excel 5th Day on Dt. 29/06/2024

- 0.53Basic to Advance Excel 6th Day on Dt 02/07/2024

- 0.54Basic to Advance Excel 7th Day on Dt 03/07/2024

- 0.55Basic to Advance Excel 8th Day on Dt 04/07/2024

- Quiz0